This post is part of an ongoing exploration into a piece of legislation introduced into the Minnesota House of Representatives by Rep. Ryan Winkler, H.F. No. 4632. The full bill text can be found here.

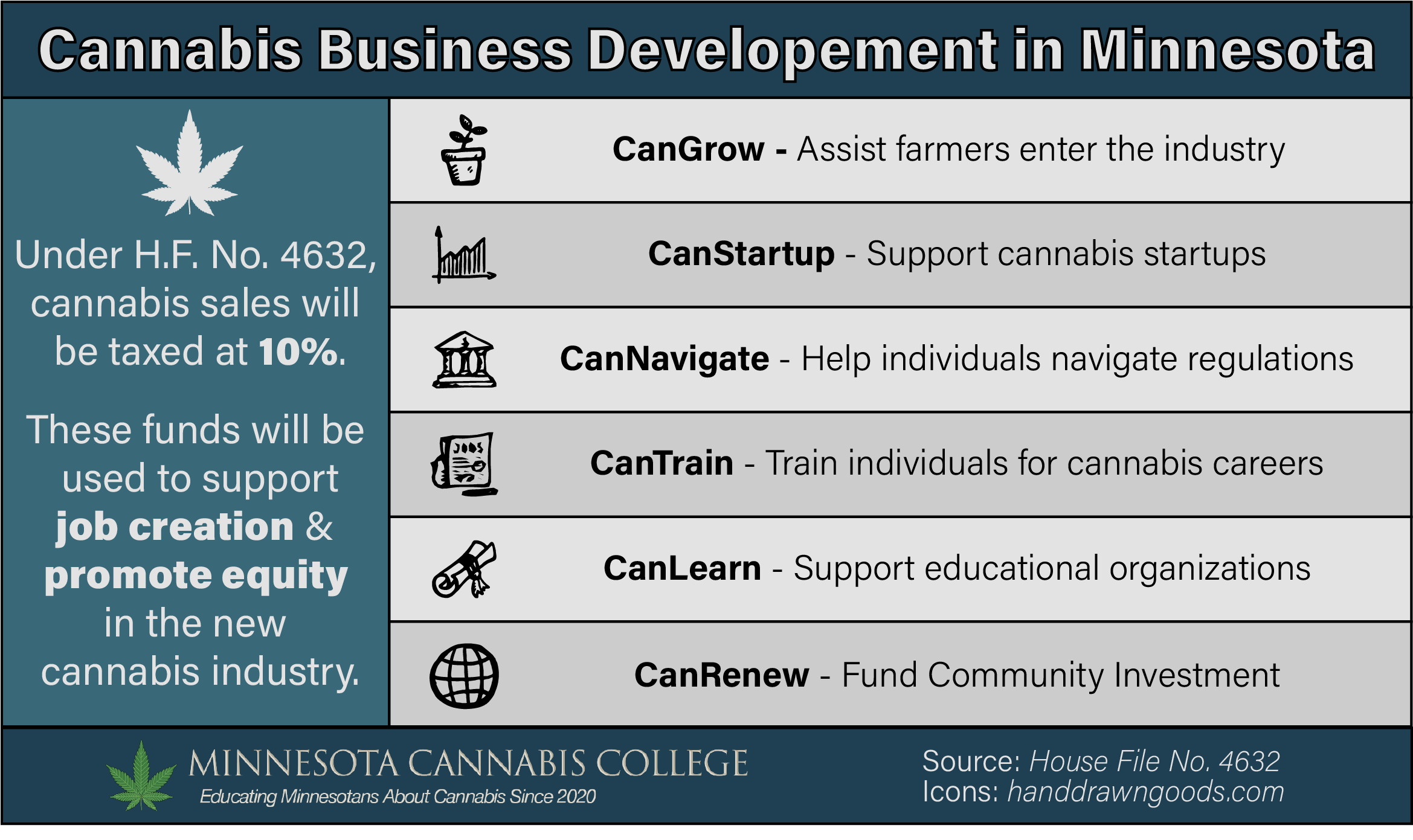

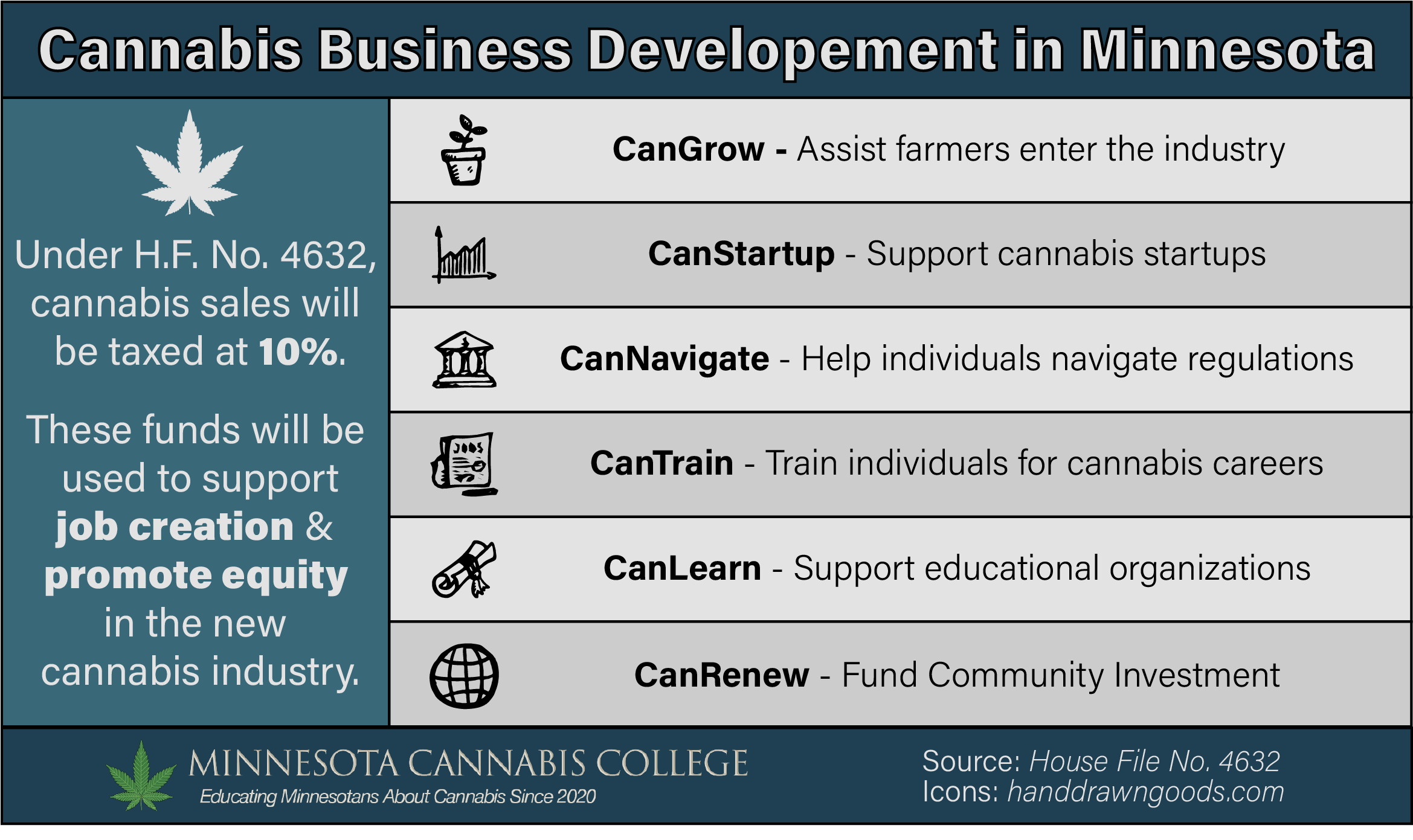

Welcome to our forth deep dive into House File No. 4632, a piece of legislation that gives us a glimpse into how a legal adult-use cannabis market might look in Minnesota. Among other things, this legislation lays out how cannabis sales will be taxed and some of what the funds will be used for. House Majority Leader Rep. Ryan Winkler said legalization was not being pursued as an “economic or revenue opportunity”, but instead, to “end the criminalization of people’s lives and the deep racial injustice that are part of that system.” In this article, we’ll explore the taxes on cannabis and the grants established to develop the newly created legal adult-use cannabis industry.

This legislation establishes a 10% tax on all retail cannabis sales. This means that consumers purchasing adult-use cannabis products (medical cannabis exempt) from either a retail or microbusiness location will pay that tax at point of sale along with the state sales tax of 6.875%. That means that spending $100 to buy cannabis will put your final price at just over $116, before any local sales tax, if applicable. Those of you who have brought their tax revenue to another state for purchasing cannabis will know that this is pretty low for cannabis-specific taxes. Michigan also has a 10% sales tax, Colorado has a 15% excise tax and a 15% sales tax, and Washington state has a 37% sales tax on cannabis. Just for comparison, a whopping 2.5% tax is applied to alcohol sales in Minnesota.

Leili Fatehi, Campaign Manager for Minnesotans For Responsible Marijuana Reform, said that a fully developed bill like H.F. No. 4632 allows for a more in-depth policy discussion. This is especially true when compared to bills in the past that were focused more on beginning the discussion. “We can bring in more subject matter experts and kind of dig into what are the pros and cons of that 10% rate,” said Fatehi, “An appropriate tax rate from my perspective is one that supports the commercial viability of a legal market against a black market and is one that brings in sufficient revenue to offset the costs of running the regulatory program.”

Along with establishing a tax rate for cannabis sales, this piece of legislation also determines how some of that money is to be used: to develop an equitable cannabis market. It does this through multiple grant programs designed to ensure each sector of the industry is accessible to all Minnesotans. It also establishes a community investment fund to support projects and programs in communities most effected by the war on drug users.

“These kinds of grant funding programs are important because if we’re going to legalize, we want to be able to set up people for success,” explained Fatehi. Some states with legal adult-use markets, such as Colorado, have created programs designed to break down some of the barriers to entering the market for social-equity applicants. Colorado-based organizations provide training, mentorship, and assistance in securing financing to Colorado-based businesses. Lack of access to capital and ancillary services are one of the biggest barriers for social equity applicants looking to enter the cannabis market in Colorado today, and their accelerator program seeks to address just that.

Sponsors of the legalization bill in Minnesota are looking to preempt some of the challenges experienced in other states. To that end, this legislation sets up five business development grants: CanGrow, CanStartup, CanNavigate, CanTrain, and CanLearn. It also establishes a community investment fund called CanRenew. Priority on all grants must be given to social equity applicants (or businesses in communities where residents are eligible to be social equity applicants).

Cannabis Grower Grant (CanGrow)

The CanGrow grant program is designed to help farmers navigate the new cannabis industry (and the applicable government regulations). Funds from this program must be used to support farmers in entering into the legal cannabis industry with a emphasis on farmers who are eligible to be social equity applicants.

Cannabis Industry Startup Financing Grants (CanStartup)

CanStartup is a program to award funds to nonprofits that support new businesses in the cannabis industry via loans. Preference will be given to organizations which can support networking, establish community relationships, and implement economic development projects. That means that if you are looking to start a cannabis business, you won’t receive a check with “State of Minnesota” on the ‘From’ line, but instead from a partner organization who will provide the funding along with additional support.

“Because of the federal situation around cannabis, it’s really difficult for people to get loans to start up their business,” explained Fatehi, “Especially if you’re looking at people from those communities that have been especially impacted by prohibition.”

“This has set up all kinds of opportunities for predatory lending, so we’re really happy to see that there are these programs that allow for that state to provide some of that funding to offset that kind of risk.”

Cannabis Industry Navigation Grants (CanNavigate)

Government regulations can be difficult to understand and comply with at times, especially in a new and developing market. The CanNavigate grants would fund organizations that help individuals to navigate industry regulations while ensuring that they remain in compliance.

Cannabis Industry Training Grants (CanTrain)

While the demand for labor in the cannabis market will increase significantly post-legalization, the training programs to prepare individuals for that workforce have not yet been created. This grant would both fund organizations to train people in the cannabis space while also providing funding for individuals to receive that training.

Cannabis Industry Learner Grants (CanLearn)

Similar to CanTrain, CanLearn focuses on providing funding for necessary career education. In fact, the language for the two statutory sections are very similar, however CanTrain is overseen by the Commissioners of Employment and Economic Development, and CanLearn is managed by the Commissioner of Labor and Industry. While these two programs will certainly work in tandem, there are a few differences, such as CanLearn programs must include a “classroom” and “hands-on” components whereas CanTrain programs do not.

Cannabis Industry Community Renewal Grants (CanRenew)

The final grant program established, CanRenew, focuses not on cannabis business development but instead on community investment. This program will provide funding to organizations looking to improve community-wide outcomes or experiences related to economic development, violence prevention, youth development, or civil legal aid, among others.

You can read the full conversation with Leili Fatehi on the Reddit community for cannabis users and enthusiasts in Minnesota, r/MNTrees.

Cannabis Industry Training Grants how do I get for myself? I would like to start a business in this industry but need help and education

As a former prisoner of the war on drugs, these programs and their potential to build bridges between communities and organizations that have intrinsically been at odds with one another, offer so much more than means of revenue, and freedom for us. It proposes an opportunity for healing to take place in the hearts of individuals who have been looked upon with derision, disregarded in judgement, and colloquially denigrated by the majority. It is with sincere humility and joy I applaud the efforts and hearts of all our public servant’s, friends, family, and neighbors that came together to make this possible. I’m proud of you Twin Cities!!!